A Slice of a Financial Pie

The stock market is vast and there are many strategies for success. So what’s the easiest way to get started? The simplest and quickest way to get started today are index funds. Index funds allow you to own a low risk investment that grows over time. In the stock market if you own a share/stock, then you own a piece of one company. An index fund is owning pieces of many companies. Index funds can be purchased manually as an ETF (Exchange-Traded Funds) or automatically as an index mutual fund (more on this later). Let’s use food as a way to understand index funds.

Pretend the stock market is a magical bakery. You want to buy a slice of a multi flavored pie (i.e. index fund ). This pie consists of various flavors aka stocks (e.g. Apple, Kellog, Coca-Cola, Microsoft, Tesla). The bakery owner cuts the pie (index fund) into slices (stocks). Some of the slices (stocks) cost $10 and others $100. If you purchased all the slices (stocks) individually you’d spend over $100. However, purchasing the entire pie (entire index fund) is often much cheaper than buying individual pieces.

Hungry for more? Keep reading.

Reasons to Invest Today

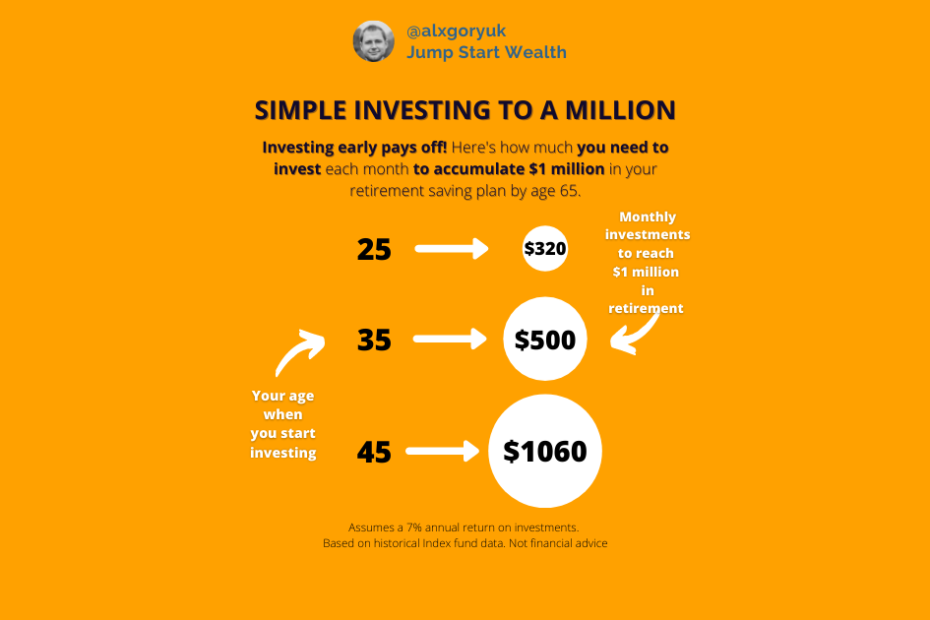

Like the Chinese proverb goes: “The best time to plant a tree was 20 years ago. The second best time is now”. Investing is similar to trees. They both need time to grow and flourish. That’s why you want to invest

today. Here’s an example of why it’s important to start sooner rather than later. Look at the graphic below. Index funds allow for passive investing. In this case if you were to pick the VTI index fund and invested a lump sum of $10K in 2010 you would have had $36K by 2020. Imagine how much more this would have grown if you invested monthly over the same span!

The most important rule is: start early as possible. The reason this all works is called compounding. Compounding works because of two factors:

- Your investments, on average, are always growing in value. From 1957 to 2018 the S&P 500 index averaged 8% return on investment.

src: https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp - Your investments continue to compound each year.

src: https://www.fool.com/knowledge-center/compound-interest.aspx

Given enough time with the average return you can easily grow your money. This is proven possible over the last 30+ years with the simplest investments. No need to pick the “best” companies”. Invest in all of them with an index fund.

Here’s another way to see the big picture. Starting early and investing in index funds pays off in retirement. At the age of 25 you only have to invest $320/mon to reach $1 million by the time you are 65. Whereas you’d need to invest $1060/mon to reach the same $1 million by 65.

Are you seeing the big picture? The sooner you start the better off you are. Let’s go step by step and make it happen today.

Step 1: Create an investment account.

First, you need to have an account with a financial company/broker such as eTrade, TD Ameritrade, Charles Schwab..etc. During the creation of this account you’ll be asked the type of investment account you’d like to create. There are usually 3 choices:

- Brokerage

- Roth IRA ( tax advantaged )

- Traditional IRA ( tax advantaged )

If you’ve already maxed out your retirement accounts then your only choice is the brokerage account. Considering that you are here reading this article, then we’ll assume you are just starting out and going to pick either the Roth IRA or Traditional IRA.

Choose and create the investment account that fits your needs. Each financial company/broker will look slightly different but will ask very similar questions. I chose the Roth IRA because I knew the money I’ll be putting in there is coming from my bank account and has already been taxed.

Step 2: Choose your investing style

There are two main ways to purchase index funds:

- ETF index fund

- Index mutual fund

An ETF is a group of stocks that can be traded like a single share/stock; a “basket”. An ETF can be traded any time of the day. On the other hand, mutual funds can only be purchased once a day. The biggest differences are how much you start with and how you purchase them. ETFs trade like stocks thus you can buy and sell them any time of the day. Mutual funds are usually only traded once a day ( end of the day ). The biggest advantage of mutual funds is you can set them on true autopilot. You can set an automatic withdrawal and investment once a month and forget about it. With ETFs you’ll have to set a monthly calendar reminder to purchase the index fund.

In all likelihood it’ll come down to whether you have the $3K to start with and how automated you want these investments to happen. Pick what works best for you and your budget. Next, let’s actually pick the funds! Keep reading.

Step 3: Choose your index funds

Now you have to pick which index funds you’ll invest in. The two most known and easiest to invest index funds are VTI and VTSAX. They both comprise of 3500+ US companies and have similar returns.

We’ll explore 2 ways you can invest starting today. The easiest and simplest is just putting $1000 into VTI or $3000 into VTSAX. You could literally place your money into one of these today and be done. If you stopped reading here you could already have accomplished a great deal for your future self. There is another option that I’d like to talk about.

Another option is more diversified. Meaning, when the US market isn’t doing well, then it’s possible the international market is doing better. This means you are hedging not just against a few companies doing poorly but also the entire country’s economy doing poorly for a time.

With option B you are investing in US companies, international companies and bonds. All three work together to help balance in times of bad economy. Usually bonds do poorly in a good economy and modestly in a good economy. Again, it’s all about hedging against risk and not necessary to get started. Picking just VTI or VTSAX is good enough to get started.

Step 4: Set it and forget it

Now you are ready to transfer your funds from your bank to your financial company/broker. And most importantly to actually make the investment. Once you’ve transferred funds to your financial company/broker then simply search for the index fund you want such as VTI or VTSAX ..etc

If you’ve chosen the Option A then simply put 100% ( $1000 / $3000 ) of your funds into VTI/VTSAX. If you’ve chosen VTSAX you’ll need to break apart that investment into your three fund portfolio. Here’s what it looks like in terms of percent.

Another way to think about the breakdown of the investment is in dollars. Here we are going to keep it simple and use $1000 as an example of how this would look like for ETF index funds. If you choose mutual funds it’s a bit more because each mutual fund requires $3K of initial investments.

Again, you don’t have to go for diversification when starting out. It’s just as easy to add more picks later on. The most important part for your future is starting today.

Step 5: Celebrate

Seriously, celebrate! This is a huge milestone to reach in your life. You should be proud of having gone through all the steps to get here.

I hope you enjoyed learning and investing in your future. Remember, knowledge is only useful when applied. Take action today to setup for success tomorrow.

One More Thing

Thanks for reading! You can learn more about budgeting, building wealth and changing lives by clicking on https://JSWbook.com ( SaveMyCents readers get a 20% discount by using code SMC20 during checkout ).

Follow me on Instagram @alxgoryuk and Twitter @alxgoryuk for more wealth building tips.

Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.